Tsp withdrawal calculator

You will find the savings withdrawal calculator to be very flexible. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

How Much Does A 500 000 Annuity Pay The Annuity Expert

First you can wait until you qualify for age-based TSP withdrawals at.

. There are several options for withdrawals that avoid the 10 percent early-withdrawal tax penalty. Many people feel the need to withdraw funds from their TSP plan due to hardship or other emergency. Ad Its Time For A New Conversation About Your Retirement Priorities.

You can start receiving SEPP distributions immediately as a penalty-free TSP withdrawal. First how much are your investments presently worth. Form tsp 70 is the form you need to fill up and submit when making a request for a full and immediate withdrawal of your entire vested.

Ad Its Time For A New Conversation About Your Retirement Priorities. A post-separation withdrawal of a participants entire TSP account through an annuity a single payment or monthly payments or a combination of these three options. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

The TSP annuity calculator can help sort through the choices to see how each one would affect the amount of the payment during your life expectancy and if a survivor. At age 56 monthly payments begin at 108885. While it is most frequently used to calculate how long an investment will last assuming some.

To calculate your investment withdrawal amount for this year well need to answer a few questions. The TSPs Retirement Income Calculator was used for these figures. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve.

Taxes owed on 110000 at 22. Add up all of your income. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

The only catch is that you must stick to this plan for five years or until you reach the age of 595. If you want to avoid paying taxes on the taxable money in your TSP account for as long as possible do not to take any distributions until the IRS requires you to do so. By age 65 she has reached 161323 per month.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Our Resources Can Help You Decide Between Taxable Vs. For information about in-service withdrawal options visit the In-service withdrawals basics section of tspgov and download our updated booklet In-Service.

Tsp Full Withdrawal Tax Calculator. Build Your Future With a Firm that has 85 Years of Investment Experience. It shows you the.

The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. This calculator will show you how much you might earn over the lifetime of investing with regular contributions at a given rate of interestreturn. You need to carefully plan your distributions from your TSP to supplement your retirement income gap so that you do not bump yourself.

Use this calculator to help determine the impact of lost contributions and. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

Financial Calculators Tools Fidelity

How To Calculate Your 21 Day Fix Calorie And Container Level 21 Day Fix Diet Beachbody 21 Day Fix 21 Day Diet

Want Clarity So You Can Retire Watch This Video Csrs Service History And Catch 62 To Exchange Conf Federal Retirement Retirement Benefits Investment Advisor

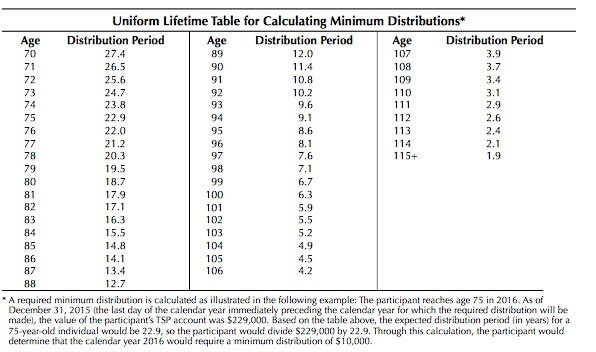

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Federal Retirement Calculators Federal Benefits Information Center

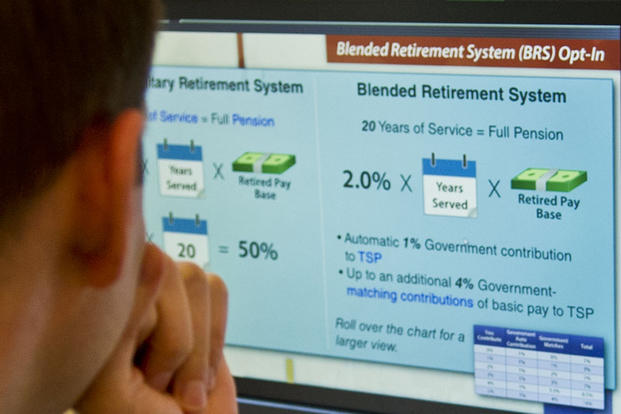

The Blended Retirement System Explained Military Com

Accrued Interest What It Is And How It S Calculated

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

The Best Time To Withdraw From Your Tsp Account Minerva Planning Group

2

The Solo 401k The Entrepreneur S Guide To A Powerful Pension Plan How To Plan Types Of Planning 401k

4 Things To Consider Before Moving Your Tsp Savings Usaa

Easy Egg Fried Rice Is Made With Just A Few Ingredients This Better Than Takeout Dinner Is Easy In 2022 Cheese Burger Soup Recipes Frozen Salmon Easy Orange Chicken

401k Calculator

Start Planning With Our Fers Retirement Calculator Retirement Benefits Institute Retirement Calculator Retirement Benefits Retirement Planner

3 Ways To Calculate Retirement Benefits In Kenya Wikihow

Military Retirement Pay Calculator Military Onesource